tax planning services introduction

Tax planning and reporting After completing this training you will be ableto. Tax planning is one of those things we all say we do.

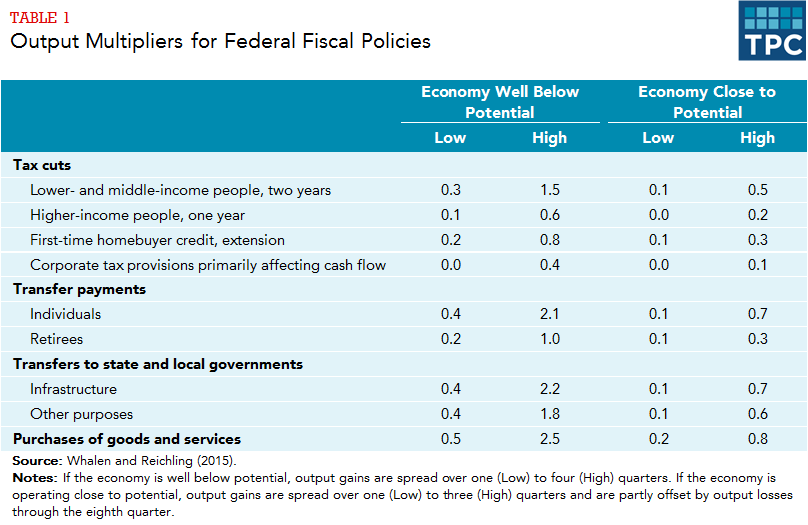

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Tax planning is the analysis of a financial plan or a situation to make sure that there is tax efficiency and you pay the lowest taxes possible.

:max_bytes(150000):strip_icc()/GettyImages-CA21828-6efa3d1061f04e47b23487ce9917a985.jpg)

. It is the analysis of ones financial situation from the tax efficiency point-of-view. Basic steps to plan taxes. Ad Make Tax-Smart Investing Part of Your Tax Planning.

21 The Business. Statistics has it that in the united states of America alone there are about 118890 registered and licensed Tax Preparation Services firm responsible for employing about 292718 and the. The main purpose of tax planning is to make sure you approach taxes efficiently.

Postponing taxes is still an important tax-saving technique of Tax Planning. Tax planning is the logical analysis of a financial position from a tax perspective. Tax planning reduces your tax liability by employing effective strategies that explore ways that.

Sole proprietors can put up to 20 percent of earnings into a tax. Know more by clicking here. Topics COVID-19 Accounting Audit Firm Management Payroll Small Business Tax Reviews Product Service.

Examples of Tax Planning Strategies. Owners of corporations can contribute up to 25 percent of their salary to a tax-deferred plan like a 401k. Tax planning services introduction Monday April 18 2022 Edit.

The office building will be located in Madison Wisconsin USA. Tax planning services introduction Monday April 18 2022 Edit. Tax planning involves the analysis of your financial.

You pay 12 on the rest. The first step includes understanding your total income from all sources. Not only that but personalized tax planning is something low-cost online advisory services dont offer.

Identify the federal state and local taxreporting requirements of a small business and its owner and establish a. Ad Reduce Risk Drive Efficiency. Understand the objectives of tax planning in India and its various types along with their benefits and importance.

We have high standards and only recommend professionals with a track record of success. Heres a sampling of the services we offer. If you had 50000 of taxable income youd pay 10 on that first 9950 and 12 on the chunk of income between.

Any time a product or service is developed or. If you are employed it would be. INTRODUCTION TO TAX PLANNING AND MANAGEMENT Taxes are the compulsory contribution by the citizens of a country for meeting different government expenditures.

Connect With a Fidelity Advisor Today. Tax planning is the process of optimizing and reducing your tax liability through various strategies. Ad A good tax preparer will help simplify your filing and make sure its done right.

Connect with a Accountant instantly. It can include a number of services. It is impossible to avoid paying taxes when running a business.

How to Build a Tax Planning Practice. Tax Planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances. Free estimates no guessing.

Ad Free price estimates for Accountants. Actually you pay only 10 on the first 9950. Tax planning is commonly defined as the manner of forecasting your tax liability and creating circumstances and ways to reduce it.

ConsulTax will be a registered and licensed tax preparation service owned by George Brad. Understand your gross annual income. Know more about tax planning.

The Basics of Tax Planning. The definition of tax planning is quite simple. Chances of lower tax brackets in the future.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Tax planning is the analysis and arrangement of a persons financial situation. Two words consistency and focus.

I love tax planning because its so easy to quantify the results for clients. Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc. Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and.

Objectives of Tax Planning. Identify the federal state and. Cant pay entire tax burden.

Tax planning is a focal part of. We all talk about providing tax planning services even our websites talk about tax. While you can always pay your taxes.

Connect With a Fidelity Advisor Today. Start crossing things off your list today.

/GettyImages-936538294-c7bc85f4feda496b97d7c52b2d6f799d.jpg)

Introduction To Accounting Information Systems Ais

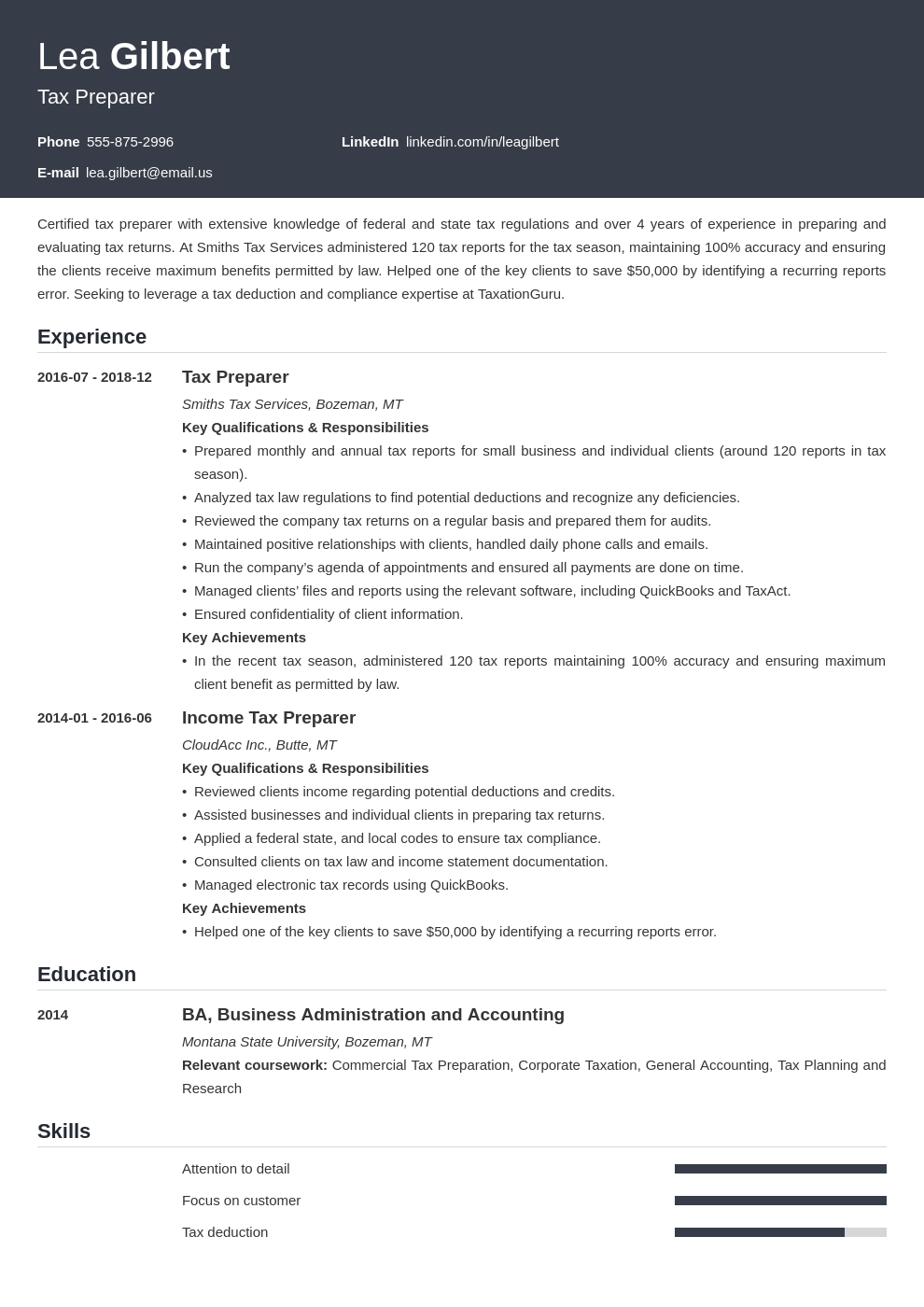

Tax Preparer Resume Sample Writing Guide 20 Tips

Tax Planning For Us Individuals Living Abroad 2022 Deloitte Us

Tax Planning For High Net Worth Individuals Bmo Private Wealth

Tax Planning Meaning Importance It S Benefits Edelweiss Mf

:max_bytes(150000):strip_icc()/GettyImages-CA21828-6efa3d1061f04e47b23487ce9917a985.jpg)

Introduction To Tax Laws And Regulations

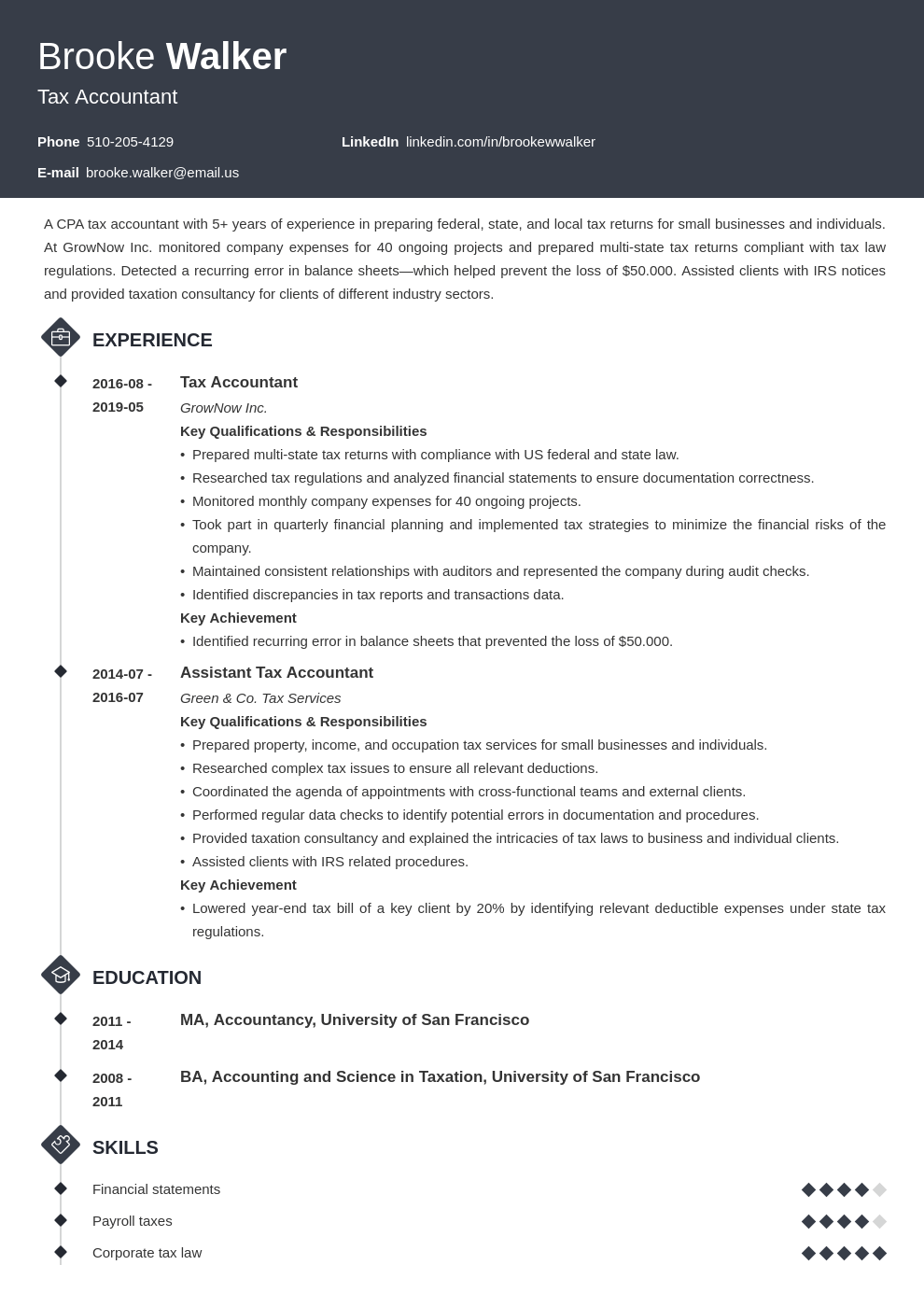

Tax Accountant Resume Sample Guide 20 Tips

Moss Adams Accounting Consulting Wealth Management

Indian Tax System Taxation Structure In India Current Policies Explainedaegon Life Blog Read All About Insurance Investing

Private Wealth Tax Planning Pwc Channel Islands

American Tax Returns Don T Need To Be This Painful The Atlantic

Difference Between Tax Planning And Tax Management With Comparison Chart Key Differences

/taxes_83402612-5bfc357546e0fb005146b209.jpg)

2 Ways Hedge Funds Avoid Paying Taxes

Difference Between Tax Planning And Tax Management With Table Ask Any Difference

Tax Preparation In Pasadena Md Tax Preparation Bookkeeping Services Pasadena

/two-business-people-calculate-their-business-in-the-office--918789230-5dfe7ee1921b4b74a28798a8f5c2e762.jpg)

/GettyImages-1086691530-d383bde425ae4d8abe8d5319b0bdbcc7.jpg)